LONDON (ICIS)--The use of plastics in packaging has been thrust into the spotlight in recent months. A renewed focus on marine waste including microplastics as well as still high landfill rates for plastics has led for calls for a reduction in single-use plastics.

In January, the European Commission introduced the first ever Europe-wide strategy on plastics. This included spending on research and strategic investment in waste management. The EU is aiming for 55% of the plastics used in packaging to be recycled by 2030.

Consumer goods companies and retailers alike are looking for ways to fit into this trend. Unilever in January committed to 100% recyclable plastic packaging by 2025. Many market commentators believe this leaves polystyrene (PS) out in the cold. For example, influential think-tank the Ellen MacArthur Foundation believes that to achieve goals like this on recycling rates, a significant rethink of packaging is needed.

One of its suggestions is removal of “uncommon plastic packaging materials of which only relatively low volumes are put on the packaging market, such as polyvinyl chloride (PVC), polystyrene (PS) and expanded polystyrene (EPS)”.

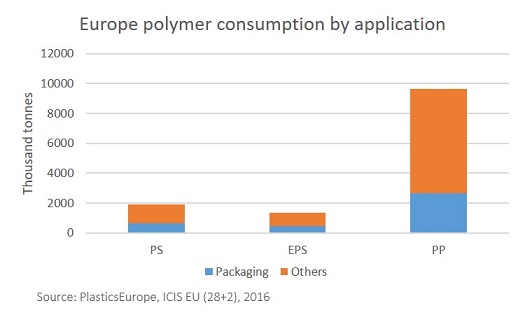

PlasticsEurope suggests that some 34% of European PS is used for packaging. According to ICIS that is over 600,000 tonnes/year. There is also an additional 400,000 tonnes or so of EPS.

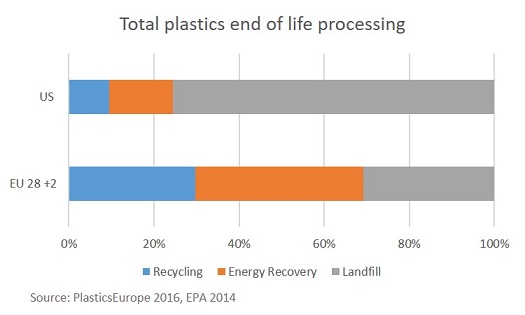

There are no specific figures for how much of this is recycled. 31% of all EU plastics are recycled but we know that the proportion of PS and EPS is far less.

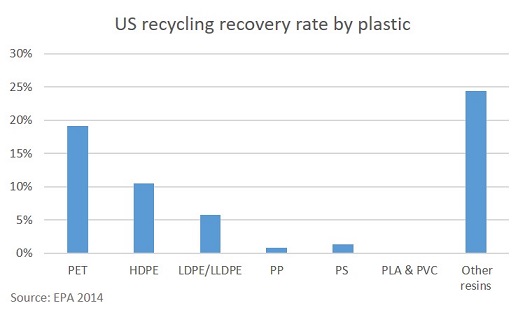

In the US where 10% of all plastics are recycled, only 1% of PS is recovered for recycling. We can assume then in Europe only low single-digit percentages of PS and EPS are recovered.

Recyclers point out that there is nothing intrinsically hard about recycling PS compared to competitor polymers like polypropylene (PP).

EPS has challenges with its very low density. Here the main problem is the cost of transport – with one articulated lorry carrying less than half a tonne of product. An on-site densifier or crusher can improve that but is only a worthwhile investment for large consumers.

For PS packaging like yoghurt pots, contamination is an issue with recycled product needing to be clean of food product, foil lids and paper labels. This can be tricky, expensive in terms of labour costs and leads to high water consumption.

One option for this dirtier product was to send it overseas.

In 2016, 37% of the EU’s plastics recycling was sent outside the union for processing. A lot of this ended up in China, where large waste processor used cheap labour to process harder to recycle plastics.

In 2018, the Chinese ban on importing these plastic waste streams has put a halt to this business. Chinese processors are looking to set up operations in alternate developing economies like Vietnam or Indonesia. But for the moment this avenue for product has been vastly reduced.

Other technologies are being developed that get round these difficulties. One of these is the Agilyx process, reported on in Insight last year, which relies on pyrolysis.

Here, any residue or impurities are burnt up and come out as a char. Major producers Americas Styrenics (Trinseo and Chevron Phillips JV), and INEOS Styrolution have signed development agreements with Agilyx.

In Europe, PlasticsEurope (the industry federation) last June launched an industry initiative to drive innovation recycling solutions for PS.

This group too is looking at chemical recycling to convert collected post-consumer polystyrene waste into virgin polystyrene instead of the mechanical solutions currently in place.

However, the main problem with PS recycling is the much-smaller scale of material that discourages collection and processing.

PP volumes in packaging are more than two times bigger than PS (and EPS).

Polyethylene terephthalate is also around double the total PS and EPS packaging volumes.

Maybe moving current PS volumes into PP and PET would make the process easier with more efficiencies of scale both in collection and processing.

However, moving between polymers is not as easy as it sounds. Convertors and consumers need to re-tool existing machines to cope with different polymers. This process is expensive and lengthy.

PS has some unique properties that appeal to consumers – including the snappable effect that makes it so popular for form fill seal applications like yoghurt pots, butter packets, blister packs etc.

Innovation is enabling other polymers to do this too, but not without cost.

PS also has far wider processing window than many plastics (a process window is defined by the Concise Encyclopaedia of Plastics as ‘the range of processing conditions….. within which a specific plastic can be fabricated with acceptable and optimum properties’).

One convertor talked of a customer buying a machine to process either PET or PS, but then finding that the PET had a detrimental impact on the cutters.

One factor is already forcing the movement of the packaging industry away from PS. This is simply price volatility.

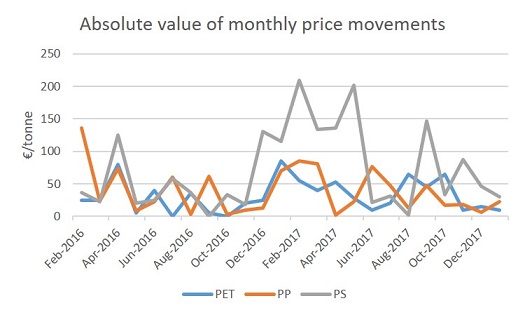

Since January 2016, the average monthly movement in the European PS price has been €71/tonne, compared to €38/tonne for PP and €32/tonne for PET.

This volatility comes largely from the styrene market, where supply issues have led to jumps in prices.

Converters across the board say this is hard to push onto the end consumer and can lead to big swings in profitability. As a result both are investing in innovation to develop other solutions. This has contributed to much lower growth rates for PS compared to other polymers.

Convertors say consumers are still considering packaging options in light of recent targets, but no firm decisions have been made yet.

The ICIS view is that there will be no revolution but that consumer pressure will add to the economic pressure and continue the move to other polymers.

This could accelerate the downturn in western markets and even in time in some Asian markets like China and Korea. It could mean ultimately that technologies to allow PS recycling are doomed as volumes of the polymer used in packaging continue the move downward.

Rhian O’Connor is a Senior Analyst in ICIS Consulting and Analytics. She publishes a monthly European Styrenics forecast report looking at market trends and forecasting pricing.

For more news and analysis on the EU’s plastics recycling policies and how they could affect the polymers and petrochemicals markets, visit the ICIS landing page