The carbon market is an environmental policy tool designed to reduce greenhouse gas emissions by assigning a cost to carbon dioxide emitted, thus providing economic incentives for reducing emissions and investing in renewable energy and energy efficiency. It operates on the principle of cap-and-trade, where a limit (cap) is set on emissions and entities such as companies or countries are granted emission permits or allowances. Participants can trade these allowances, buying additional permits if they exceed their emissions cap or selling them if they have succeeded in reducing their emissions below the cap, thereby fostering a market for carbon. This market-oriented mechanism aligns with several of the Sustainable Development Goals (SDGs), particularly SDG 13 (Climate Action), by directly incentivizing reduction in greenhouse gas emissions to mitigate climate change.

It also connects with SDG 7 (Affordable and Clean Energy) by encouraging shifts towards cleaner energy sources; SDG 9 (Industry, Innovation, and Infrastructure) by promoting the development of sustainable and innovative green technologies; and SDG 12 (Responsible Consumption and Production) by incentivizing companies to adopt more sustainable practices. Additionally, SDG 8 (Decent Work and Economic Growth) and SDG 11 (Sustainable Cities and Communities) are supported as the market drives job creation in new energy sectors and helps create sustainable urban environments.

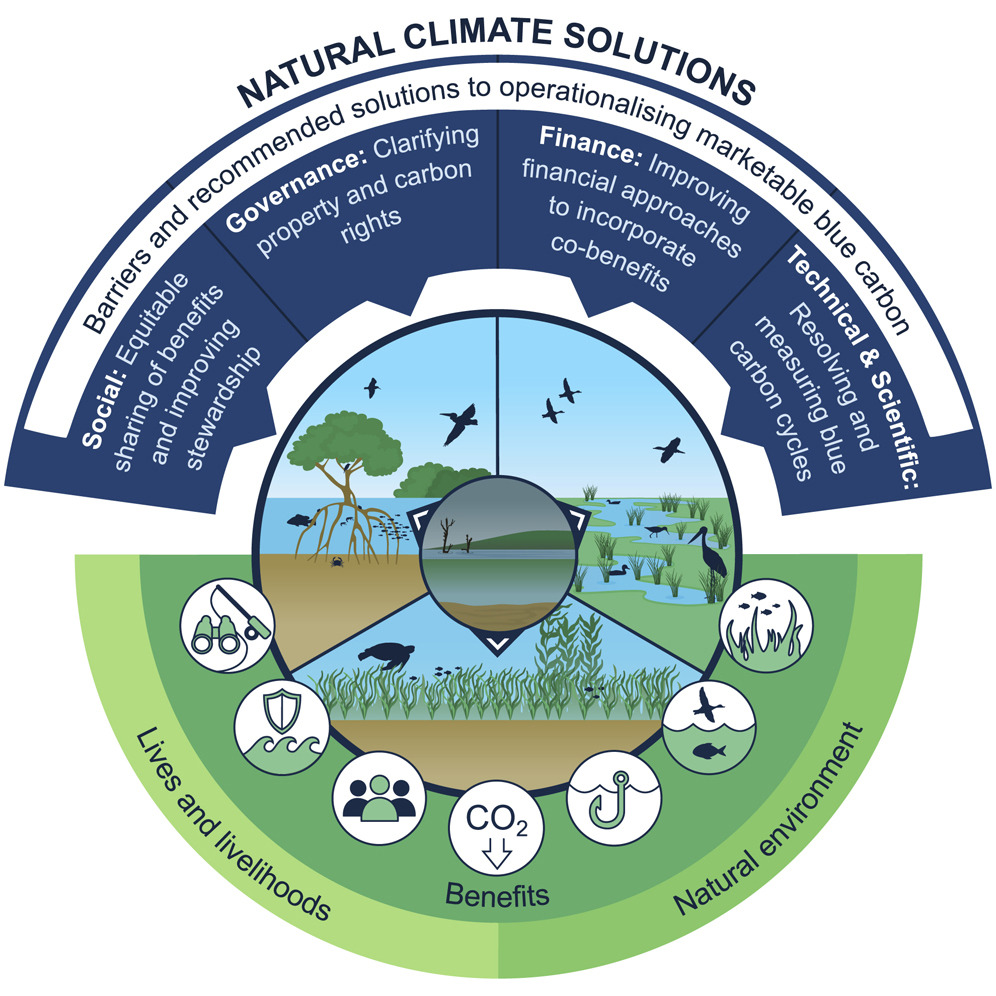

Even more, the carbon market has a secondary benefit of contributing to SDG 15 (Life on Land) and SDG 14 (Life Below Water) by funding reforestation projects and conservation efforts, as healthy forests and oceans are significant carbon sinks that absorb CO2 from the atmosphere.

The efficiency of carbon markets, however, is often debated, with criticisms including the uneven allocation of emissions allowances, the potential for market manipulation, and the challenge of ensuring that the market translates into actual emission reductions rather than merely a shift of emissions across borders, known as carbon leakage. Despite these challenges, the carbon market remains a pivotal tool for leveraging the private sector’s ingenuity and resources in the global fight against climate change, acting as a bridge between economic development and environmental sustainability and ensuring that progress in one does not come at the cost of the other.

Carbon-Based Polymer Nanocomposites for Environmental and Energy Applications, 2018, Pages 261-280.