The financial sector plays a pivotal role in the achievement of the Sustainable Development Goals (SDGs). Introduced by the United Nations in 2015, the SDGs represent a blueprint for achieving a better and more sustainable future for all by addressing critical global challenges, including poverty, inequality, climate change, and environmental degradation. But the accomplishment of these goals requires substantial resources. The United Nations Conference on Trade and Development (UNCTAD) estimates that achieving the SDGs could require investments of $5-7 trillion per year. As such, the financial industry's role is indispensable.

One of the main ways in which finance connects to the SDGs is through the provision of the necessary funding to achieve these goals. This can take several forms, including direct funding from banks and financial institutions, impact investment, which aims at generating social and environmental impact alongside a financial return, and innovative financial mechanisms such as green or sustainable bonds.

Moreover, SDG 17 explicitly recognises the role of finance, calling for strengthening the means of implementation and revitalising the global partnership for sustainable development. It seeks to mobilise additional financial resources for developing countries from multiple sources and promote a universal, rules-based, open, non-discriminatory, and equitable multilateral trading system under the World Trade Organization.

Furthermore, financial institutions can adopt sustainable practices in their operations, contributing to several SDGs. For example, by offering financial services to unbanked or underbanked populations, financial institutions can contribute to SDG 1 (No Poverty) and SDG 10 (Reduced Inequalities). Similarly, by adopting sustainable investment criteria, financial institutions can foster sustainable industries, thereby contributing to SDG 9 (Industry, Innovation, and Infrastructure) and SDG 12 (Responsible Consumption and Production).

Finally, finance plays a role in managing the economic risks associated with sustainability challenges. For instance, by taking into account environmental, social, and governance (ESG) criteria in their risk assessments, financial institutions can help mitigate the financial risks associated with climate change and other environmental and social threats.

However, integrating sustainable development into the financial sector also entails challenges. These include the need for a better understanding of the financial risks and opportunities associated with sustainable development, the need for enhanced disclosure and transparency around sustainable finance activities, and the need for more consistent and standardised sustainable finance taxonomies and metrics.

table {mso-displayed-decimal-separator:"\."; mso-displayed-thousand-separator:"\,";} tr {mso-height-source:auto;} col {mso-width-source:auto;} td {padding-top:1px; padding-right:1px; padding-left:1px; mso-ignore:padding; color:black; font-size:11.0pt; font-weight:400; font-style:normal; text-decoration:none; font-family:Calibri, sans-serif; mso-font-charset:0; text-align:general; vertical-align:bottom; border:none; white-space:nowrap; mso-rotate:0;} .xl18 {text-align:left; vertical-align:top;}

Intellectually Impaired People: The Ongoing Battle, 2023, Pages 231-237

Parents’ associations try to improve the fate of their children. The Cystic Fibrosis Foundation (CFF) was established by parents of children with cystic fibrosis when their children’s life expectancy was only a few years. They invested money they had collected in for-profit pharmaceutical companies that they assumed had good chances to develop effective therapies. They had breakthrough success with it, were able to sell the shares of these companies at a great profit, and have now more resources to further promote cystic fibrosis research and care.

This article provides a discussion of the history and the contemporary issues pertaining to Historically Black Colleges and Universities (HBCUs) in the United States. It draws upon relevant literature and provides an in depth understanding of HBCUs. In particular, the article focuses on the impact of industrial philanthropy on the leadership and curriculum of HBCUs; the intersection of the law with HBCUs, especially as it pertains to desegregation; the role of HBCUs in the civil rights movement; and the impact of Federal recognition of these institutions.

This chapter details how global educational philanthropy contributes to worsening rather than ameliorating dire public problems. It suggests that the tendency toward supporting market based educational reform concentrators private governance over education and undermines public and democratic purposes of public education.

The essay reviews important trends and issues in the scholarship on NGOs and discusses transformations in the NGO sector that need further research and analysis. The focus of the essay is on critical scholarship in NGO Studies that theorizes the impact of neoliberalism on the NGO sector, the NGOization of development and the neoliberal strategy of public-private partnerships in education and development. We analyze the growth of philanthrocapitalism, particularly in education and its implications for NGOs.

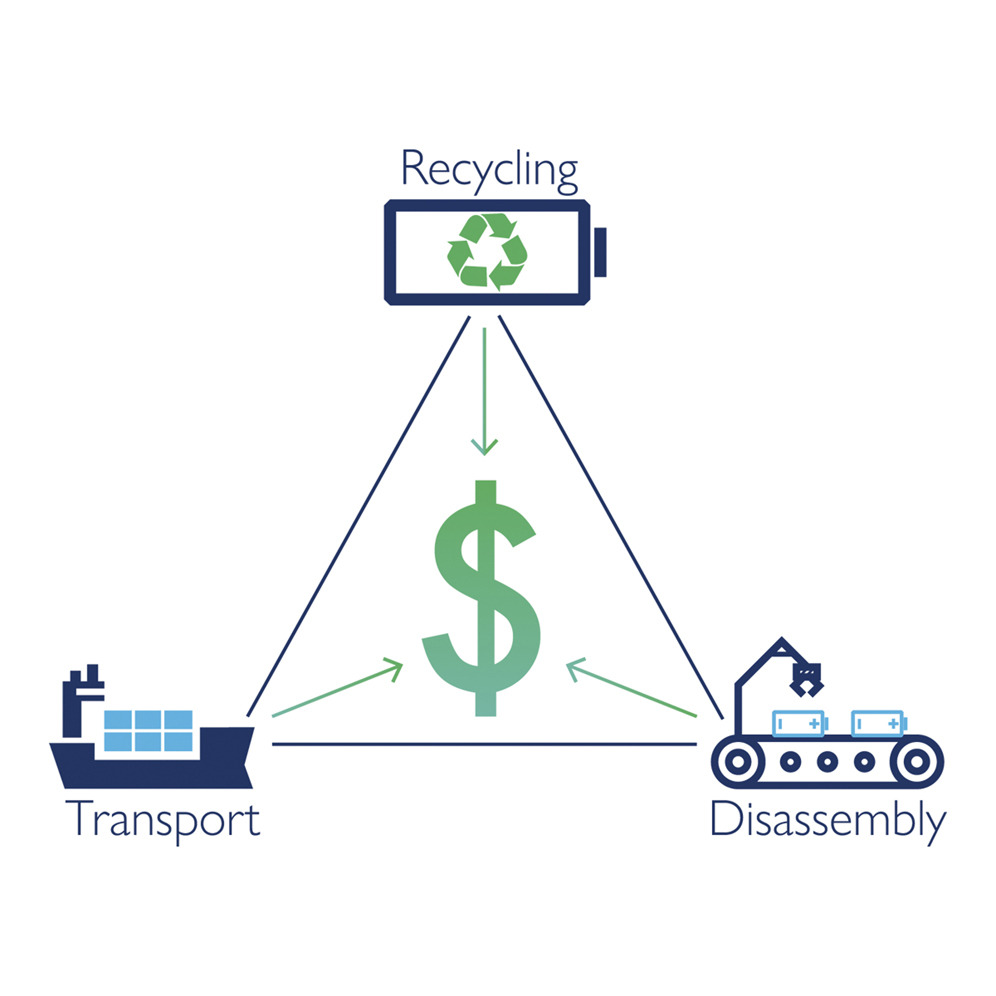

Economically viable electric vehicle lithium-ion battery recycling is increasingly needed; however routes to profitability are still unclear. We present a comprehensive, holistic techno-economic model as a framework to directly compare recycling locations and processes, providing a key tool for recycling cost optimization in an international battery recycling economy. We show that recycling can be economically viable, with cost/profit ranging from (−21.43 - +21.91) $·kWh−1 but strongly depends on transport distances, wages, pack design and recycling method.